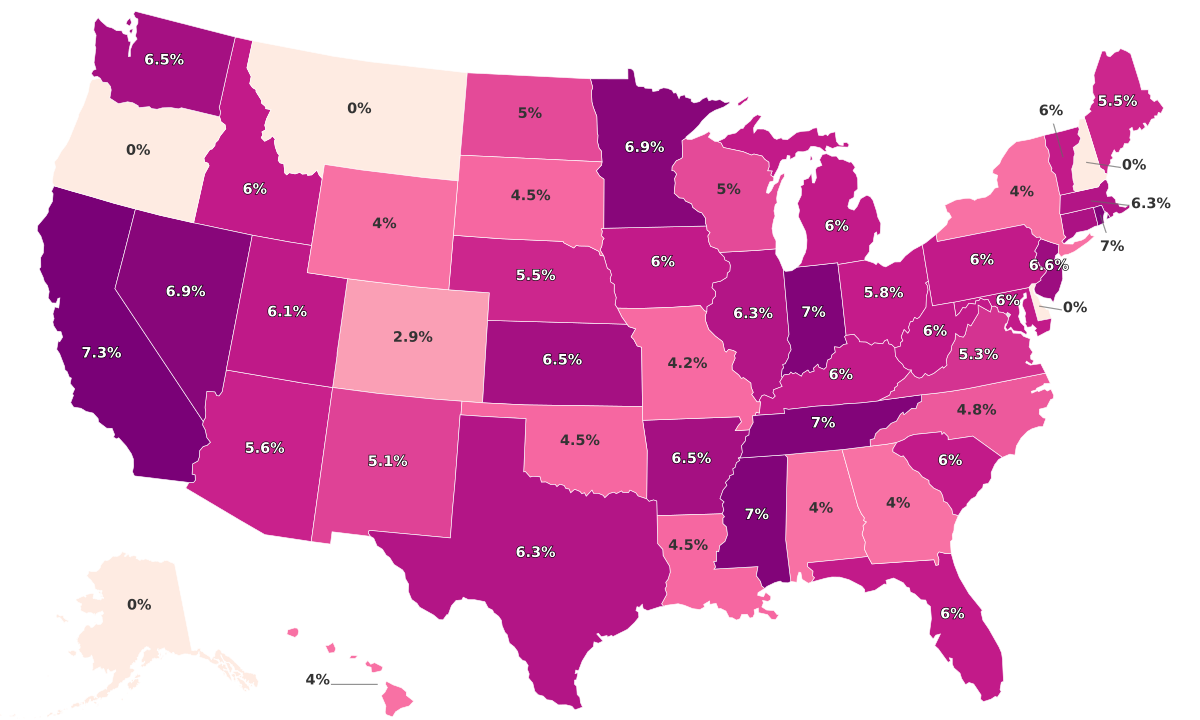

Sales Tax By State

Last updated February 28, 2026

Understanding Sales Tax across the United States

Sales tax, acting as a crucial revenue source for states, plays a vital role in shaping a state’s economic health while directly impacting consumers' cost of living. In the United States, each state has the autonomy to set its sales tax rate, leading to a broad range of sales tax rates across the nation.

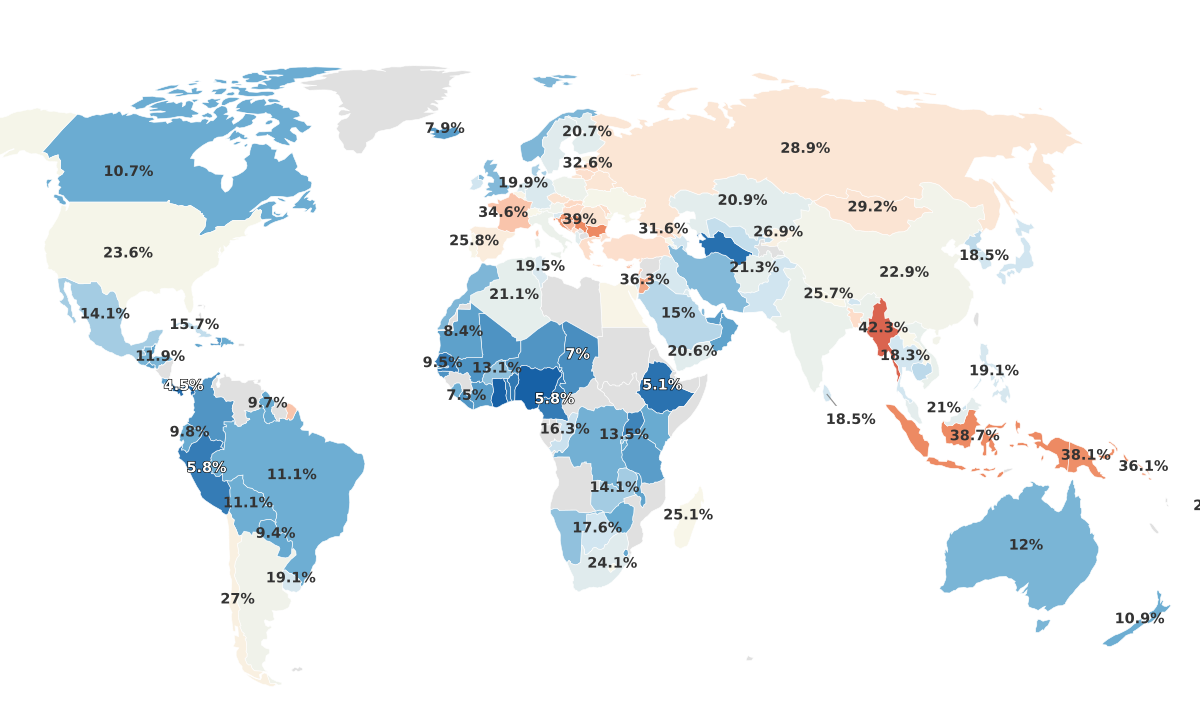

- The sales tax rates across states vary significantly, with California, at 7.3%, holding the highest sales tax rate. The majority of states have rates between 4% and 7%. On the other end of the spectrum, five states— Oregon, New Hampshire, Montana, Delaware, and Alaska— impose a sales tax of 0%.

- A little less than two-thirds of states (32) have a sales tax rate above the national average of 5.1%, while a little more than a third (18) fall below this average. This pattern suggests that the states with a 0% sales tax considerably bring down the average.

- The correlation between the population of a state and its sales tax rate is not uniform. For instance, California, the state with the highest tax rate, also has the biggest population, while states with zero tax rates, such as Alaska and Montana, have smaller populations. However, populous states like New York and Florida have a moderate sales tax rate of 4.0% and 6.0%, respectively.

- In terms of local sales taxes, two states, Alabama and Louisiana, have an average local sales tax higher than their respective state tax. Interestingly, even though Alaska has no state sales tax, the state’s average local sales tax stands at 1.76%.

- Combining state and local sales taxes gives an overarching view of the tax burden on consumers. The combined sales taxes range from 0% to a high of 9.55%. Approximately thirty-one states fall above the average combined sales tax of 6.44% and nineteen lie below it.

All Metrics

| Region ↕ | Sales Tax Rate↕ | Cost of Living Index 2024↕ | Car Sales Tax↕ |

|---|---|---|---|

| California | 7.3% | 144.8 | 7.3% |

| Mississippi | 7.0% | 87.9 | 5.0% |

| Indiana | 7.0% | 90.5 | 7.0% |

| Tennessee | 7.0% | 90.5 | 7.0% |

| Rhode Island | 7.0% | 112.2 | 7.0% |

| Nevada | 6.9% | 101.3 | 6.9% |

| Minnesota | 6.9% | 95.1 | 6.9% |

| New Jersey | 6.6% | 114.6 | 6.6% |

| Washington | 6.5% | 114.2 | 6.8% |

| Kansas | 6.5% | 87.0 | 7.5% |

| Arkansas | 6.5% | 88.7 | 6.5% |

| Connecticut | 6.4% | 112.3 | 6.4% |

| Texas | 6.3% | 92.7 | 6.3% |

| Massachusetts | 6.3% | 145.9 | 6.3% |

| Illinois | 6.3% | 94.4 | 6.3% |

| Utah | 6.1% | 104.9 | 7.0% |

| Maryland | 6.0% | 115.3 | 6.0% |

| Pennsylvania | 6.0% | 95.1 | 6.0% |

| Florida | 6.0% | 102.8 | 6.0% |

| South Carolina | 6.0% | 95.9 | 5.0% |

| Iowa | 6.0% | 89.7 | 5.0% |

| Kentucky | 6.0% | 93.0 | 6.0% |

| Vermont | 6.0% | 114.4 | 6.0% |

| Michigan | 6.0% | 90.4 | 6.0% |

| West Virginia | 6.0% | 84.1 | 6.0% |

| Idaho | 6.0% | 102.0 | 6.0% |

| Ohio | 5.8% | 94.2 | 5.8% |

| Arizona | 5.6% | 111.5 | 5.6% |

| Nebraska | 5.5% | 93.1 | 5.5% |

| Maine | 5.5% | 112.1 | 5.5% |

| Virginia | 5.3% | 100.7 | 4.2% |

| New Mexico | 5.1% | 93.3 | 4.0% |

| North Dakota | 5.0% | 91.9 | 5.0% |

| Wisconsin | 5.0% | 97.0 | 5.0% |

| North Carolina | 4.8% | 97.8 | 3.0% |

| Oklahoma | 4.5% | 85.7 | 4.5% |

| South Dakota | 4.5% | 92.2 | 4.0% |

| Louisiana | 4.5% | 92.2 | 5.0% |

| Missouri | 4.2% | 88.7 | 4.2% |

| Hawaii | 4.0% | 186.9 | 4.0% |

| New York | 4.0% | 123.3 | 4.0% |

| Wyoming | 4.0% | 95.5 | 4.0% |

| Alabama | 4.0% | 88.0 | 2.0% |

| Georgia | 4.0% | 91.3 | 7.0% |

| Colorado | 2.9% | 102.0 | 2.9% |

| Delaware | 0.0% | 100.8 | |

| Alaska | 0.0% | 123.8 | |

| Oregon | 0.0% | 112.0 | |

| Montana | 0.0% | 94.9 | |

| New Hampshire | 0.0% | 112.6 |

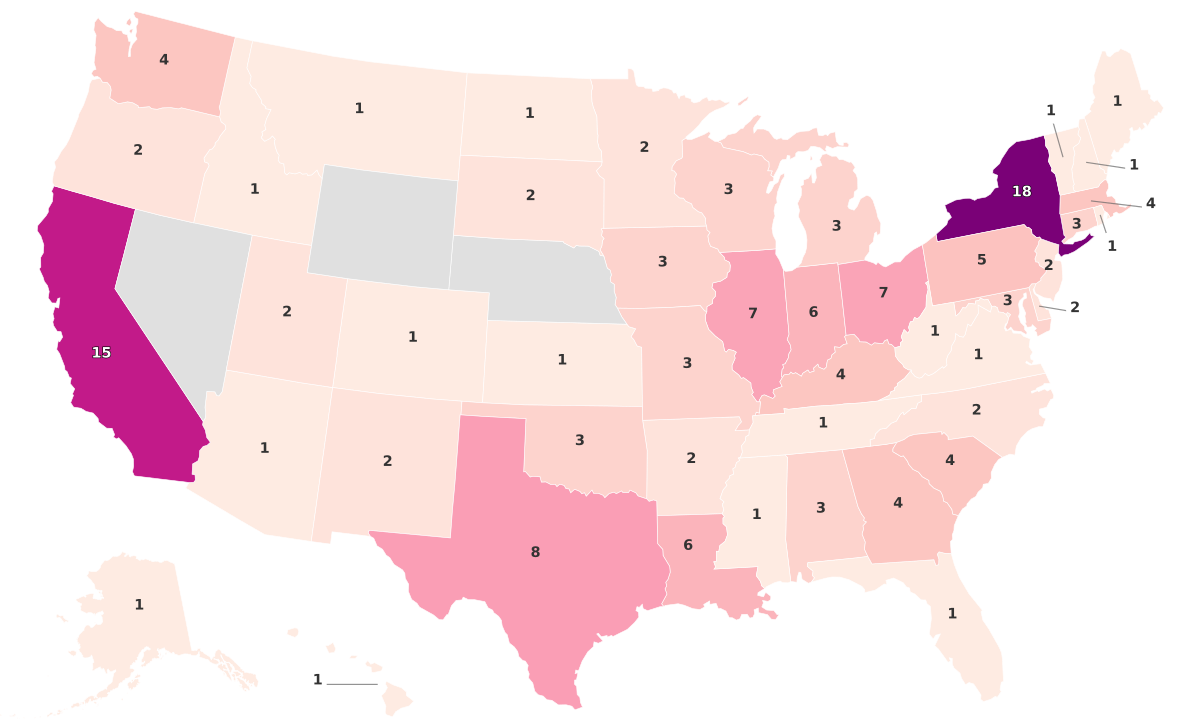

States with the Highest Sales Tax

Sales Tax varies significantly across the United States, with California, Rhode Island, Indiana, Tennessee, and Mississippi leading the pack with the highest rates. At 7.3%, California claims the title of the state with the highest sales tax, exceeding the national average by quite a margin. Rhode Island, Indiana, Tennessee, and Mississippi follow just behind, each with a sales tax rate of 7.0%. Alongside these top five leaders, Minnesota and Nevada stand out with a near-identical sales tax rate of 6.9%, only slightly below the 7% threshold. Simultaneously, New Jersey, Kansas, and Arkansas share a similar territory, featuring sales tax rates of 6.6%, 6.5%, and 6.5%, respectively. The states with the highest sales tax rates are:

- California - 7.3%

- Rhode Island - 7.0%

- Indiana - 7.0%

- Tennessee - 7.0%

- Mississippi - 7.0%

- Minnesota - 6.9%

- Nevada - 6.9%

- New Jersey - 6.6%

- Kansas - 6.5%

- Arkansas - 6.5%

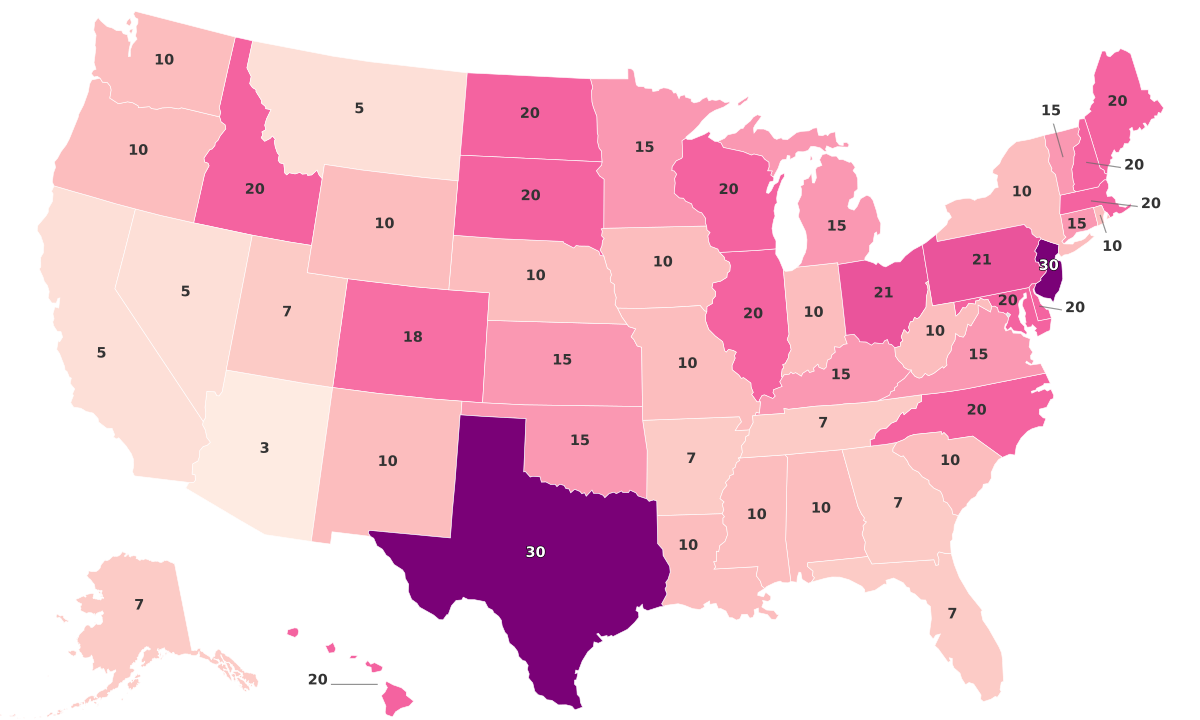

States with the Lowest Sales Tax

A total of five states do not impose any sales tax, thus bearing the brunt of the lowest sales tax rates across the nation. These include Delaware, New Hampshire, Oregon, Montana, and Alaska, all possessing a sales tax rate of exactly 0.0%. This implies no additional costs on consumer spending from a state sales tax perspective, which can be highly appealing to certain segments of the population and businesses. Ranking sixth is Colorado with a comparatively low state sales tax of just 2.9%, marginally below the 3% mark and significantly lower than the national average of 5.1%. Hawaii, Georgia, Wyoming, and New York round out the list of states with the lowest sales taxes, all holding a tax rate of just 4.0%. Despite their larger populations contrasted with several states with higher tax rates, the four states appear to maintain moderately low tax rates, thereby offering a fiscal incentive to residents and potential newcomers. States with the Lowest Sales Tax Rates:

- Delaware - 0.0%

- New Hampshire - 0.0%

- Oregon - 0.0%

- Montana - 0.0%

- Alaska - 0.0%

- Colorado - 2.9%

- Georgia - 4.0%

- Hawaii - 4.0%

- Wyoming - 4.0%

- New York - 4.0%